invisible content

XYLO Foreign Exchange lets you make foreign currency payments in three simple steps.

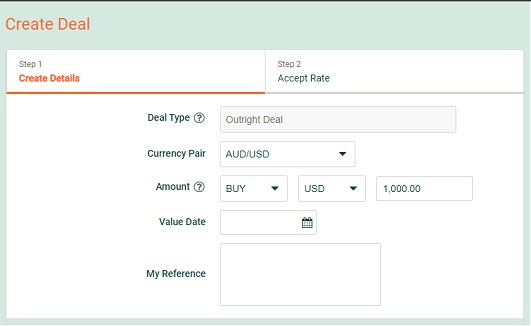

01. Book your foreign currency

Select the foreign currency you want to make your payment in.

XYLO Foreign Exchange allows you to buy or sell your Australian dollars against

a range of foreign currencies. You can book an FX rate to use on or before

the spot date (Spot date is 2 business days), or on a future date (subject to credit approval).

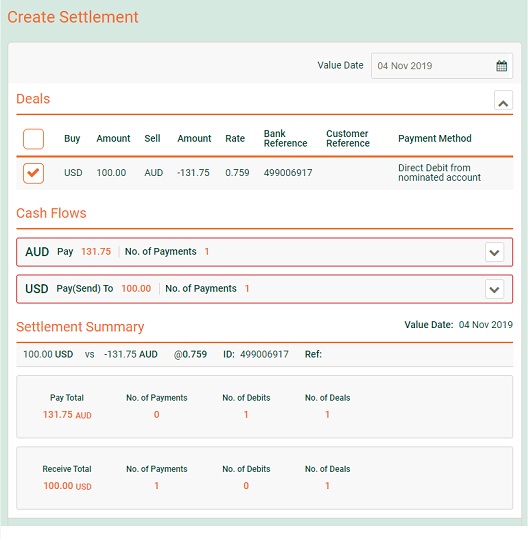

02. Create Your Settlement (Payment)

Once you've booked your foreign currency, select your payee settlement instructions

You can set up a library of payee settlement instructions within your XYLO Account.

You can select who you want to pay, how much you want to pay, and any reference details you would like to record.

You can also send a confirmation email of your payment details to anyone with an email address.

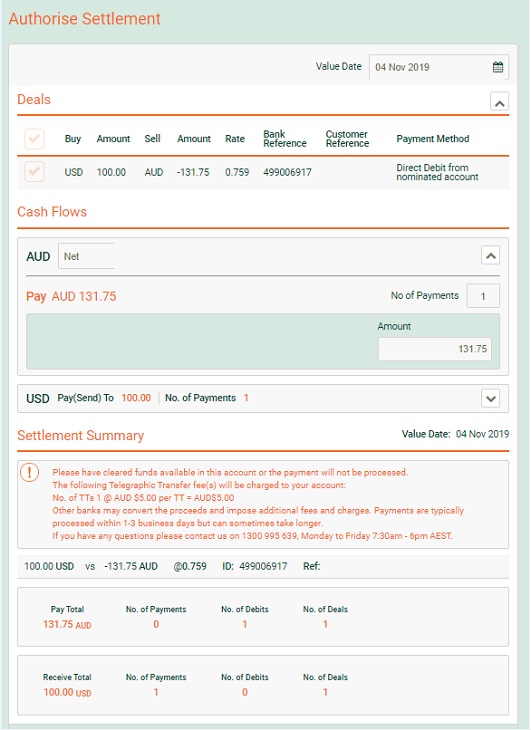

03. Authorise your settlement

Once this is done, simply check if all your details are correct and authorise your FX payment.

If any of the details are incorrect, please call us immediately on 1300 995 639 or on +61 2 9293 9501 if you are calling from overseas.

XYLO Foreign Exchange lets you set up different levels of access for any Users you've

nominated to have access to your Account. This ensures you can control and manage

exactly who is responsible for setting up and authorising your payments.

What else can you do with XYLO Foreign Exchange?

View your payment history

With XYLO Foreign Exchange you can:

- view your payment history for the past 100 days

- print off individual payment details

- search for specific payment records

- export your payment history file for accounting and reference purposes

Economic Updates

Within your XYLO Account you'll receive secure access to the latest research and

analysis from Westpac Economics, including analysis and views on RBA Statements,

Consumer Sentiments, and the GDP outlooks from Bill Evans, Westpac's Chief Economist.